Meru: Best Option for Digital Dollar Account Platform

In an era where digital finance is redefining how money moves across borders, new fintech solutions are emerging to fill gaps left by legacy banks. Meru is one such platform: a digital financial app offering users a “global dollar account,” tools for receiving, sending, saving, and spending in U.S. dollars, and various cross-border features. While not exactly a conventional bank in many jurisdictions, Meru positions itself as a modern “bank-like” solution optimized for global payments, especially for individuals in Latin America and other regions.

This article explores Meru’s features, advantages, use cases, and risks/limitations, providing a balanced overview for users considering it as part of their financial toolkit.

What Is Meru?

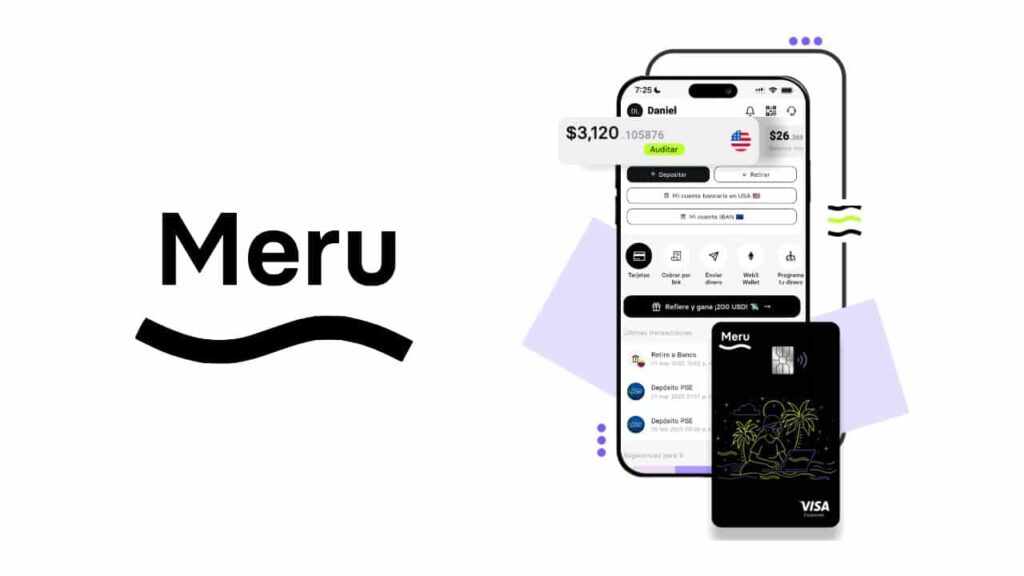

Meru (developed by R3mit Solutions Inc.) offers users a U.S. dollar-denominated account they can operate from many countries. Through the app, users may receive salaries, remittances, or platform payments into a U.S. account, hold funds in digital dollars, convert or withdraw locally, and use virtual/physical Visa/Mastercard debit cards. (Google Play)

Key features include:

- Receive a U.S. bank account in your name, including routing number and account number, enabling USD-denominated payments from U.S. sources. (Google Play)

- Local withdrawals in Latin America: users can convert and withdraw in local currencies in 14+ Latin American countries. (Google Play)

- Support for international payments: the platform enables sending USD between Meru users without fees, and withdrawing to U.S. or European accounts. (Google Play)

- Virtual and physical debit cards usable globally, enabling purchases and ATM withdrawals (subject to terms). (Google Play)

- European IBAN support: in some cases, Meru provides a European IBAN to enable banking operations in Europe. (Google Play)

- Digital dollar “save” option: users may hold balances in dollars (i.e. “digital dollars”) to protect against local inflation when operating from regions with weaker currencies. (Google Play)

Meru is available via mobile apps (iOS and Android) and aims to operate legally via identity verification (KYC / AML) processes to comply with financial regulations. (Google Play)

Key Advantages of Meru

1. Greater Access to U.S. Dollar Banking (for Users Outside the U.S.)

One strong benefit is that users in many countries (particularly in Latin America) gain access to a U.S. dollar bank account under their name. This opens possibilities: receiving USD payments from U.S. platforms (e.g. freelancing, e-commerce), wiring funds from U.S. payers, or saving in a stable currency. Many traditional local banks may not offer this to non-residents or may impose high fees. Meru simplifies that access. (Google Play)

2. Transparent or Lower Fees (for Intra-Meru Transactions)

Meru allows sending USD between Meru users without fees, which encourages peer-to-peer transfers within the platform. (Google Play)

While external conversions or withdrawals will carry costs or spreads, the internal transfers help reduce friction for users who commonly transact among themselves.

3. Local Withdrawals and Currency Conversion

For users in Latin America, a key selling point is the ability to withdraw or convert USD into local currency and access it locally. Thus, you can keep funds in dollars yet spend domestically when needed. This is especially attractive in economies with volatile exchange rates or capital controls. (GetMeru)

4. Global Card Spending

Meru’s virtual and physical card options give users flexibility to spend abroad or online in various currencies. This reduces the need to carry multiple cards or maintain local foreign currency balances. (GetMeru)

If you don’t have the exact local currency, the app can convert appropriately (subject to exchange rules). (GetMeru)

5. Hedge Against Local Currency Devaluation

By enabling users to hold balances in U.S. dollars, Meru provides a shield against inflation or devaluation in local currencies—common in many emerging markets. Users can “park” funds in a more stable currency until they need to convert or withdraw. (Chrome-Stats)

6. Consolidated Personal & Business Accounts

Meru offers both personal and business functionalities under one umbrella. Users can manage payments, receipts, and balances in one app rather than juggling multiple services. (GetMeru)

Limitations, Risks, and User Caveats

While Meru offers attractive features, it is important to understand its constraints and potential risks:

- Non-traditional banking status: In many jurisdictions, Meru is not a full bank in the classical sense. It operates as a fintech or payments provider. That may limit what protections, deposit insurance, or banking services (loans, credit) are available.

- Verification or KYC delays: Some users have reported difficulties or delays completing identity verification or document approval, which may limit immediate access. (Apple)

- Account holds or fund retention: Users have complained about funds being retained or “on hold” without clear immediate resolution from support. (Apple)

- Reliability concerns and support issues: Some reviews cite app instability, inability to add funds, or delays in technical or customer support responses. (Apple)

- Fee structure on external operations: Conversion, withdrawal and cross-platform movements may incur nontrivial spreads or fees. For large transactions, these may add up.

- Regulatory risk: As with many fintech platforms, regulatory environments may change. Local or international rules (exchange controls, banking laws, tax laws) may affect Meru’s operations or user access.

- Limits on services: Meru currently doesn’t replace features like lending, credit cards, mortgages, or more complex banking services. Users may still need a traditional bank for those purposes.

Use Cases & Ideal Users

Meru is likely most attractive for:

- Freelancers, content creators, and remote workers who receive payments from U.S. companies or global platforms and want USD access without needing to open a U.S.-based bank.

- Residents of Latin American countries or emerging markets where accessing foreign currency is restricted or challenging.

- Individuals seeking to preserve purchasing power by holding USD rather than local currency in inflationary environments.

- Cross-border spenders or frequent travelers who need a card usable in multiple currencies without excessive conversion hassle.

It is less suited for those whose primary financial needs are domestic only, or who require robust credit, lending, or local branch banking services.

Conclusion

Meru positions itself as a bridge between local users and global U.S. dollar banking. Through virtual U.S. accounts, global payment mechanisms, card spending, and local withdrawal options, it provides a compelling set of tools for users operating across borders.

However, as with any fintech, it carries certain limitations: it is not a full bank everywhere; support and verification may lag; and certain operations may incur fees or delays. It is best viewed as a complementary financial tool—especially for those who need dollar access but live outside the U.S.

If you like, I can also prepare a version optimized for SEO (with keywords) or a Spanish version. Would you prefer that?